After strikes on Iran's nuclear facilities, global markets are bracing for a new wave of instability. Which sectors of the economy will be hit first and how long the crisis will last — we discuss with experts

President Donald Trump announced U.S. military strikes on Iranian nuclear sites, claiming key facilities in the nuclear program were hit. Experts are analyzing how this could affect world markets and the global economy.

The digital assets market showed the most notable swings. Reuters reported muted immediate market reactions due to the weekend, with declines limited to cryptocurrencies - Ethereum dropping over 5% and Bitcoin down 1%. Analysts expect volatility to rise as trading resumes this week.

Analysts warn oil prices could jump to $80-100 per barrel under worst-case conditions.

Mark Spindel, Chief Investment Officer of Potomac River Capital, said:

Markets will react with immediate concern, sending oil prices higher at the opening bell... The lack of clear damage assessments will fuel uncertainty and volatility, particularly in crude markets.

Jamie Cox, Managing Partner at Harris Financial Group, forecast that oil prices would initially surge before leveling off, noting that

Iran's forfeiture of nuclear potential deprives it of its principal pressure mechanism - a factor that may drive Tehran toward accepting a peace settlement.

Mark Malik, Siebert Financial’s CIO, argues that the U.S. action 'should have a favorable impact on markets,' with the resolution expected to rapidly reduce the market turbulence stemming from prolonged uncertainty about Washington’s position.

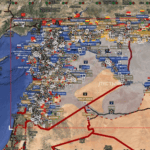

Particular concern surrounds the potential disruption to shipping in the region's strategically vital straits. At the same time, Asian markets could suffer more severely than others due to their high dependence on energy imports.

Jack Aplin, Chief Investment Officer at Cresset Capital, stressed that 'this event adds a new layer of complex risks,' while Sol Cavonic, Senior Analyst at MST Marquee, warned Iran could strike U.S. oil infrastructure in the region or disrupt shipping in the Strait of Hormuz — moves that could push prices toward $100 a barrel.

In the same context, Rong Ren Gu of Eastspring Investments noted:

The U.S. strike represents a significant escalation that could prolong geopolitical tensions... Asian markets are particularly sensitive to high energy prices, which may exacerbate inflationary pressures and impact growth rates.

As for Alex Morris of F/M Investments, he anticipates an immediate oil price surge to at least $80 per barrel, given that

… the timing of Saturday's strike was calculated to minimize market disruptions.

Eric Byersch of Sound Income Strategies warned Iran could resort to unconventional retaliatory strikes in case of a 'nuclear leak,' while Christopher Hodge, Chief Economist at Natixis, said the economic impact would remain limited unless Iran's export capacity is affected — noting any oil price spike might not be taken seriously by the U.S. Federal Reserve unless sustained.

The current situation is unfolding against the backdrop of a prolonged confrontation between Western countries and Middle Eastern states. Additional factors include rising inflation in the global economy and the growing role of Asian countries in world energy markets. In the coming days, the most likely consequences may include an increase in Brent crude oil prices, a strengthening of the dollar's position as a "safe haven," and heightened volatility in Asian stock markets

"All Russia."

The report is based on data from international news agencies and expert analysis.